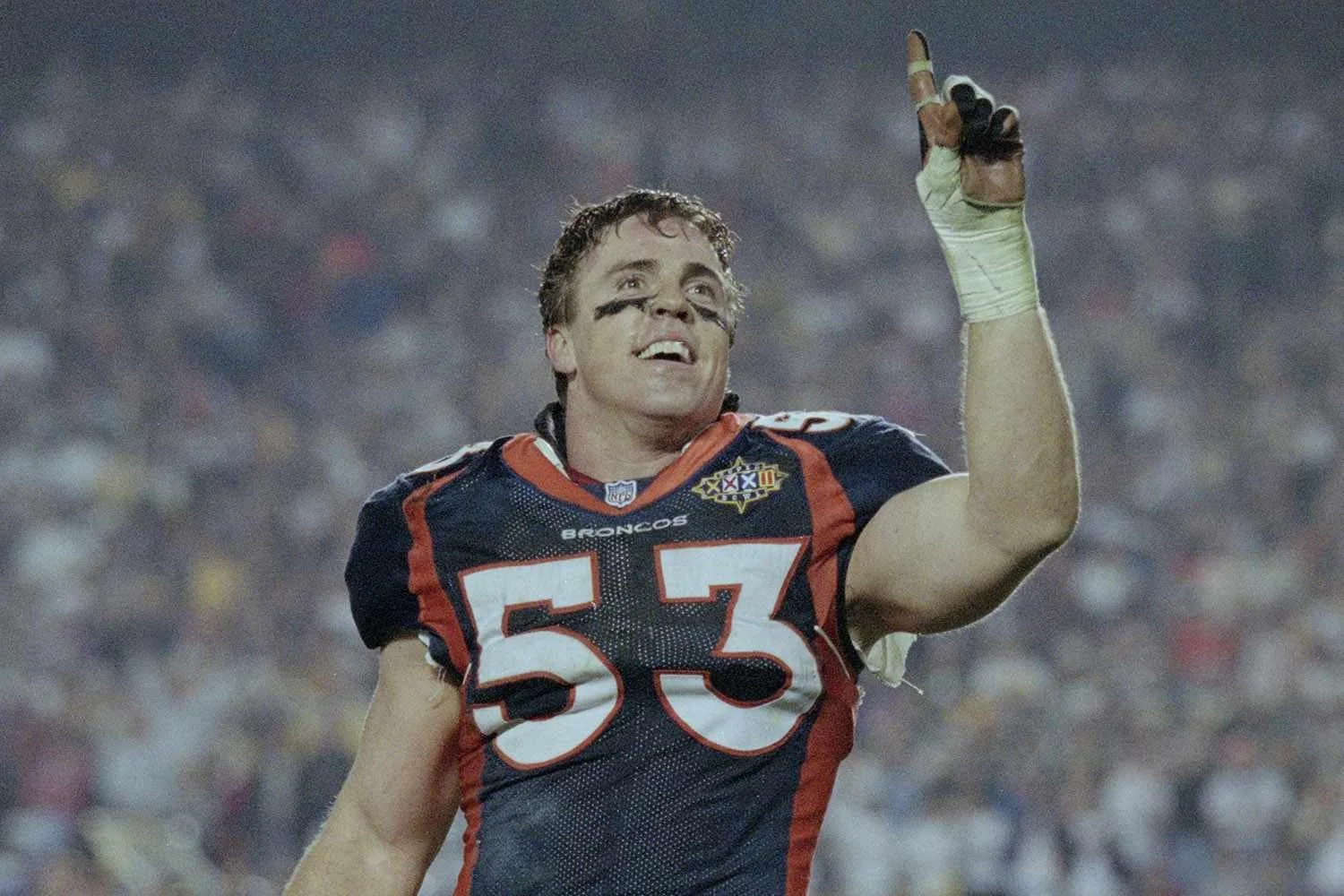

Romanowksi Gets Big Bill from IRS

NFL Linebacker, Supplement Company + Tax Evasion. The only thing juicier than this story is the stuff athletes were putting in their bodies in the 90s. The federal government is suing former NFL linebacker Bill Romanowski for $15.3M in back taxes, allegedly due on income earned in the late 90s and early 00s.

According to the courts, he used his supplement company N53 to cover personal-expenses, including groceries, plastic surgeries, spa and chiropractic appointments, essentially reducing the income claimed in that company and lowering their tax liability.

Outside of not wanting to mix personal and business expenses for liability purposes (piercing the corporate veil anyone?), no deduction is allowed in the course of business unless it is both ordinary AND necessary for your trade or business. This means any personal-expenses are a no-go, and even supposed “business expenses” you benefit too much from personally (eg expenses to maintain your appearance in your line of work, certain work-related clothes) are also not deductible.

It appears Romanowski and his wife filed for bankruptcy in May 2024 as a result of the proceedings.